Giving

Bequest

- Leaving a specific dollar amount or a percentage of your estate.

- Giving a specific asset, such as real estate, artwork, or jewelry.

- Naming HBS as a residual beneficiary of your estate, so that the School receives the remainder after all other bequests have been satisfied.

- Designating HBS as the sole or a partial beneficiary of a retirement plan such as a 401(k) or IRA.

Because HBS is constantly evolving to meet the changing needs of business and society, many donors don’t specify a purpose for their bequest, allowing the School to use their gift where it is needed most. If you prefer to direct your gift to a specific purpose, the Office of Planned Giving can help you or your attorney craft a bequest that reflects your wishes.

Here is suggested language to share with your attorney or other advisor when making

or updating your will:

I give (____ dollars/___percent or all of the residue of my estate) to the President

and Fellows of Harvard College, a Massachusetts educational, charitable corporation,

for the benefit of Harvard Business School.

- Costs you nothing during your lifetime

- Helps fulfill your financial, tax, and estate planning goals

- Membership in the John C. Whitehead Society

- Your class receives credit for the full amount of your intended gift (starting in the 50th reunion year)

John C. Whitehead Society

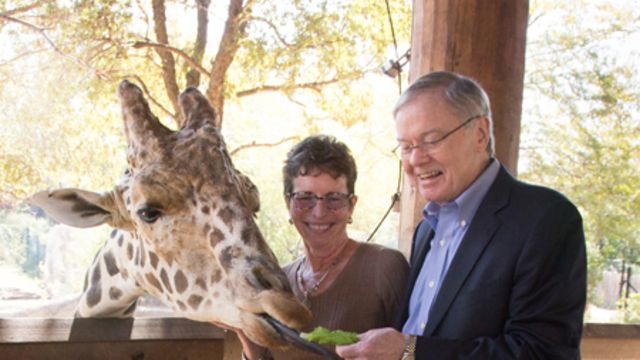

Rebecca Sumner Lien (MBA 1993)

Hal (MBA 1968) & Diane Brierley

Let’s Work Together

pg@hbs.edu